Tax form processing is both required and extremely technical. Worse, making mistakes on the forms can be both painfully costly in corrections and penalties, as well as frustrating. Too often, firms and organizations expect their general accounting unit to handle anything tax-related since it seems to be accounting in nature. However, tax reporting and form processing are a very different part of finance than general accounting and, surprisingly, many accounting staff are not automatically trained in tax processes before they come into the job. All of the above makes it clear why specialized staff and skills are critical for successful tax form processing in any organization of size.

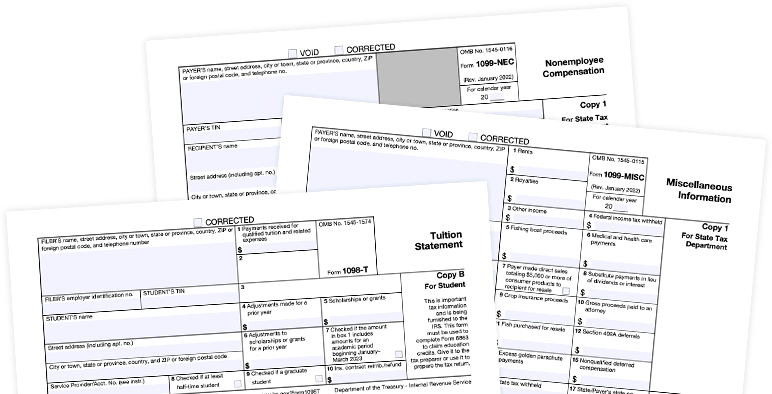

Our tax processing and e-filing services are ideal for organizations with high volumes of forms. As a trusted 1098-T and 1099 service provider, Tab Service Company makes year-end tax time less taxing. Our platform is secure and compliant, and our outsourcing services save you time and money. Our software is constantly updated to reflect the latest IRS rules and regulations, and we guarantee that all deadlines are met.