Our Benefit Fund Administrator Solutions

Benefit fund administrators work within strict compliance and fiduciary requirements. Participant communications must be accurate, timely, and compliant, while annual tax reporting requires processing thousands of forms with zero tolerance for error. Meanwhile, manual data entry, document management, and correspondence consume staff resources that could focus on plan oversight and participant service.

Tab Service Company provides comprehensive business process outsourcing tailored to the unique regulatory and operational demands of benefit fund administration. With the highest standards for data security, fiduciary responsibility, and audit readiness, we streamline contribution processing to increase participant services, ensure compliance, and reduce operational costs.

Our Benefit Fund Solutions:

- Participant communications and benefit statements

- Tax form processing and IRS e-filing (1099-R, 1095-B/C)

- Document management and digital archiving

- Data entry and forms processing

- Survey services for participant satisfaction

Benefit Fund Administration Services

Explore Our Detailed Services Provided to Benefit Fund Administrators

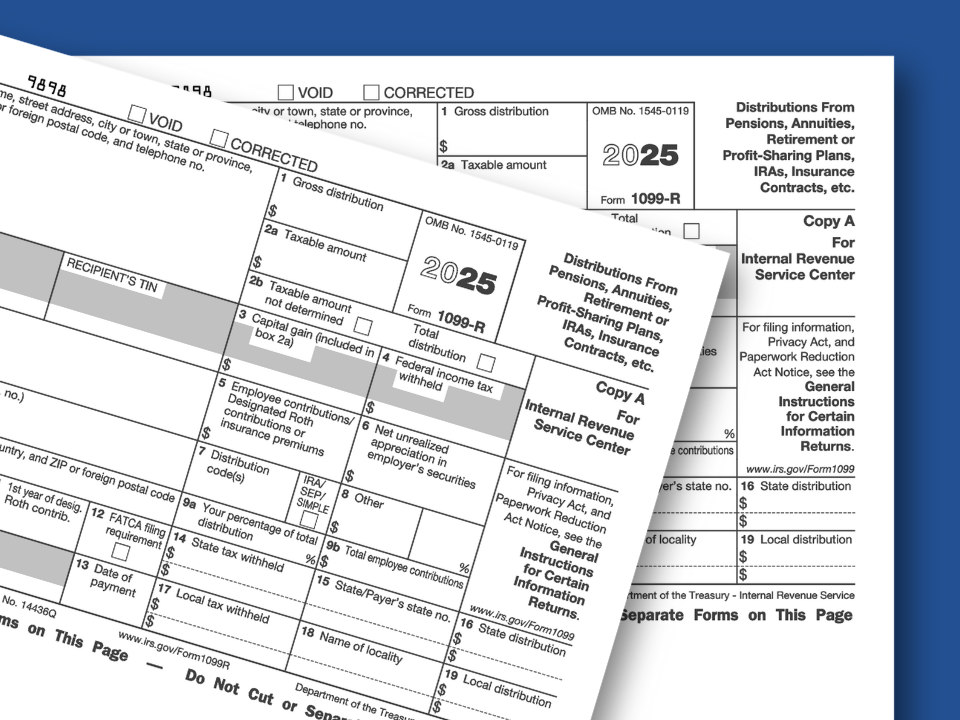

Tax Form Processing & IRS E-Filing

Streamline your annual tax reporting with our comprehensive solution designed specifically for benefit fund administrators. We handle the entire process, ensuring complete compliance while eliminating the administrative burden on your fund staff. Our platform processes all required tax forms for pension, health, and welfare plans with unlimited corrections included at no additional cost.

Tax Forms We Process

- 1099-R: Pension and annuity distributions

- 1095-B: Health coverage reporting (fully-insured plans)

- 1095-C: Employer-provided health coverage (self-insured)

- 1099-MISC/NEC: Professional service payments

- W-2: For fund administrative employees

Participant Communications & Benefit Statements

Ensure timely and compliant delivery of all required participant communications while reducing internal production costs and administrative burden. We handle everything with DOL-compliant formatting, multi-channel delivery options, and complete proof of mailing documentation. Our variable data printing capabilities allow for personalized communications while maintaining professional presentation and regulatory compliance.

Services We Provide

- Annual funding notices and participant notices

- Summary Plan Descriptions (SPD), Summary of Benefits and Coverage (SBC), and Summary of Material Modifications (SMM)

- COBRA notifications and continuation coverage

- Open enrollment materials and benefit election forms

- Quarterly and annual participant benefit statements and eligibility confirmations

Document Management & Digital Archiving

Eliminate costly physical storage while ensuring instant access to fund documents for DOL audits, trustee reviews, and daily operations. Our document digitization services transforms your files into searchable digital archives with professional indexing and ERISA-compliant retention management. Support distributed fund offices, remote trustees, and rapid audit response with secure web-based access to any document in seconds.

Common Applications

- Plan documents, amendments, and Summary Plan Descriptions

- Trustee meeting minutes, resolutions, and governance documentation

- Annual contribution reports and employer remittance records

- Participant enrollment forms and beneficiary designations

- Actuarial valuations, audit reports, and Form 5500 filings

Data Entry & Forms Processing

Speed up eligibility determinations, benefit calculations, and enrollment processing with our secure data entry services specifically designed for multi-employer benefit plans. Our dual-verification workflows ensure 99.9% accuracy and eliminating backlogs during open enrollment periods and ensuring timely eligibility determinations. We integrate directly with major benefit administration platforms for seamless data flow.

Services We Provide

- Monthly employer contribution report data entry and reconciliation

- Participant enrollment and change forms processing

- QDRO (Qualified Domestic Relations Order) data capture

- Pension application and beneficiary election processing

- Claims forms and appeal documentation entry

Survey Services & Participant Satisfaction Research

Gather actionable feedback from participants and retirees to support plan design decisions, measure satisfaction with benefit offerings, and demonstrate fiduciary responsibility. Our comprehensive survey services handle everything from multi-modal distribution to high-volume data processing to deliver clean datasets and executive summaries that inform trustee discussions on plan improvements, provider selections, and benefit modifications.

Services We Provide

- Participant satisfaction surveys across health, pension, and welfare benefits

- Retiree surveys measuring adequacy and service quality

- Open enrollment feedback and benefit utilization studies

- Provider network satisfaction (healthcare plans)

- Plan design research to inform trustee decisions

Why Benefit Fund Administrators Choose Tab

Benefit Fund Expertise

We understand ERISA, Taft-Hartley, DOL regulations, Form 5500 requirements, and the complexities of multi-employer benefit plans

Security & Compliance First

SOC 2 Type II certified, ERISA compliant, with encrypted data transmission, comprehensive audit trails, and fiduciary-grade security

System Integration

Direct compatibility with major benefit administration platforms (Employco, Janus, BeneSys, Futureplan, CONEXIS, DSI)

Audit Ready

Complete documentation, audit trails, and process controls that satisfy DOL examinations and annual financial audits

Cost Efficiency

Reduce operational costs while improving accuracy, speed, and service quality

Scalability

Handle volume fluctuations (open enrollment, year-end, contribution cycles) without staffing challenges

Benefit Funds We Serve

- Health & Welfare Funds – Multi-employer health, dental, vision, and life insurance plans requiring participant communications and contribution processing.

- Pension & Retirement Funds – Defined benefit and defined contribution plans needing 1099-R processing, participant statements, and document management.

- Combination Funds – Integrated health, pension, and training funds administered together requiring coordinated services.

- Apprenticeship & Training Funds – Union training programs needing student records, compliance documentation, and communications.

- Vacation & Holiday Funds – Seasonal benefit funds requiring contribution tracking and participant payment processing.

- Third-Party Administrators (TPAs) – Benefit administration firms managing multiple funds and plans requiring scalable outsourcing capacity.

- Union Associations – Labor organizations administering member benefit programs and services.

Technical Capabilities for Benefit Funds

Data Formats & Standards

- Common Formats: CSV, XML, JSON, fixed-width, PDF, Excel

- Tax Forms: IRS FIRE system, ACA reporting specifications

- Export Options: Database imports, API integrations, custom formats

Security & Compliance

- SOC 2 Type II audited annually

- ERISA fiduciary standards compliance

- IRS-authorized e-file provider

- DOL regulatory compliance

- Encrypted data transmission

- Role-based access controls

- Comprehensive audit trails

- Business continuity and disaster recovery

Measurable Results

Client Success Stories

40-50%

Reduction in labor hours for tax reporting

SOC2

Audited for data security, privacy, and processing integrity

35%+

Average cost savings with print & mail services

“We’ve managed to send out about 440,000 tax forms accurately and on time, which is a really big deal for us. They’re very easy to work with — they always meet deadlines, respond fast, and communicate well. In comparison to all the vendors that I had worked with before, Tab Service Company is the most responsive. Whenever we have an issue or a question, they respond to us within the day. I’ve been working in IT for over 40 years, and they’re one of the easiest vendors I’ve ever worked with.”

Pricing & ROI for Benefit Funds

Transparent, Fund-Friendly Pricing

We understand benefit fund economics and the fiduciary responsibility to manage expenses prudently while maintaining quality service.

Typical Cost Savings

- Contribution Processing: Faster with 30-50% lower costs than in-house staff

- Tax Forms: 50% savings vs. in-house processing

- Participant Communications: 30-40% reduction through postal optimization and production

- Document Management: Eliminate off-site storage and retrieval costs

- Data Entry: Per-transaction pricing below fully-loaded FTE costs

Flexible Pricing Models

- Per-transaction pricing

- Per-piece pricing

- Monthly subscription for predictable ongoing services

- Hybrid models combining base fees + volume pricing

- Multi-service bundle discounts

- Scalable pricing that adjusts with participant counts

Return on Investment

- Reduce administrative expenses

- Improve participant service and satisfaction

- Ensure compliance and reduce risk of DOL penalties

- Scale operations without proportional expense increases

- Redeploy staff to high-value participant counseling

- Support fund growth and expanded benefits