-

1099 Reporting Thresholds 2026: When New Filing Requirements Take Effect

With tax year 2025 reporting season underway, many businesses are asking when the One Big Beautiful Bill Act (OBBBA) threshold changes to 1099 forms take effect. This guide provides the…

-

2026 Tax Form Deadlines: 1099 & W-2 Information Returns

As businesses prepare for the 2026 tax filing season, understanding when 1099s are due and other critical IRS filing deadlines is essential for compliance and avoiding costly penalties. This complete…

-

SOC 2 Type II vs Type I: Which Should You Require from Vendors?

You’re evaluating vendors who will handle your sensitive data: customer records, financial information, tax documents, or employee files. Some vendors have SOC 2 Type I reports and others have SOC…

-

IRS 1099 Form Changes for 2025: What’s Different and What You Need to Do

Tax forms rarely grab headlines, but small changes can create big headaches if you’re caught unprepared. The IRS has rolled out several targeted updates to 1099 forms for the 2025 tax year, and if you’re still using last year’s approach, you could face compliance issues when filing season arrives.

-

IRS FIRE System Retirement 2026: Understanding the Transition to IRIS in 2027

The IRS has announced the retirement of its FIRE (Filing Information Returns Electronically) system, marking the end of a filing platform that has served taxpayers for over four decades. Organizations…

-

What to Look for in a Trusted BPO Partner

Business process outsourcing has become a strategic imperative for organizations looking to scale efficiently, reduce costs, and focus on their core competencies. But choosing the right BPO partner isn’t just…

-

![1099 Software Guide: Features, Options & Choosing the Right Solution [2025]](https://www.tabservice.com/wp-content/uploads/2025/12/pexels-artempodrez-6779716-1024x683-1.jpg)

1099 Software Guide: Features, Options & Choosing the Right Solution [2025]

Filing Form 1099 correctly and on time is a critical compliance requirement for businesses, but the process can be complex, time-consuming, and fraught with potential for costly errors. As organizations…

-

![1099 Processing Companies: What They Do & How to Compare Them [2025]](https://www.tabservice.com/wp-content/uploads/2025/10/Compare.png)

1099 Processing Companies: What They Do & How to Compare Them [2025]

The IRS requires businesses to file over 1.5 billion information returns annually, with Form 1099 accounting for a significant portion of this compliance workload. As tax regulations become more complex…

-

Why Data Security Should Be Your #1 Priority

Data has become the lifeblood of organizations across every industry. From customer information to proprietary business intelligence, the data you manage represents not just operational value, but trust. That trust…

-

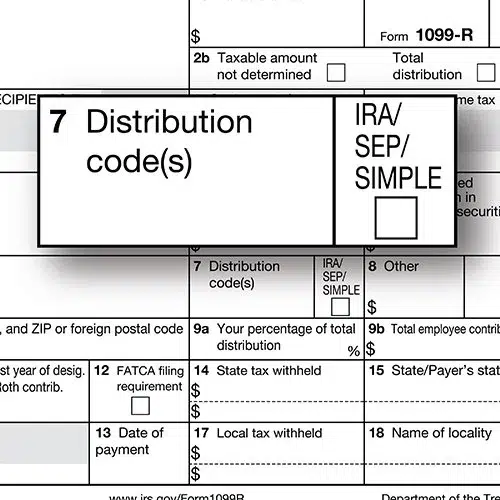

New Distribution Codes for Form 1099R

What is Form 1099R? The 1099-R, issued to individuals, reports retirement income to the IRS that they receive from a qualified retirement plan, such as a 401K, IRA or pension…

-

Where is the Best Place to Store Legal Documents?

In today’s rapidly evolving digital age, the storage and management of legal documents are crucial for businesses and individuals alike. With increasingly sensitive information generated and exchanged daily, finding the…

-

Law Firm Data Security Guide: Everything You Need to Know

In today’s digital age, law firms handle vast amounts of sensitive and confidential data on a daily basis. Protecting this data from cyber threats is essential to maintaining clients’ trust…