With tax year 2025 reporting season underway, many businesses are asking when the One Big Beautiful Bill Act (OBBBA) threshold changes to 1099 forms take effect. This guide provides the facts you need.

What Thresholds Apply Right Now in 2026?

FOR 2025 TAX YEAR (Filing NOW in Early 2026):

- 1099-NEC & 1099-MISC: $600 threshold

- 1099-K (Third-party networks): $20,000 AND 200 transactions

- 1099-K (Payment cards): No threshold

FOR 2026 TAX YEAR (Filing in Early 2027):

- 1099-NEC & 1099-MISC: $2,000 threshold (NEW)

- 1099-K (Third-party networks): $20,000 AND 200 transactions

- 1099-K (Payment cards): No threshold

Bottom line: If you’re filing right now, use $600 for 1099-NEC/MISC. The $2,000 threshold applies to payments made in 2026 (filed in 2027).

The 1099-NEC and 1099-MISC Threshold Change

The One Big Beautiful Bill Act (Public Law 119-21) was enacted July 4, 2025. It increases the 1099-NEC and 1099-MISC threshold from $600 to $2,000 for payments made after December 31, 2025.

What This Means

For 2025 payments (filing now): $600 threshold applies

For 2026 payments (filing in 2027): $2,000 threshold applies

Critical Points

✓ The threshold applies per contractor – Each vendor is evaluated separately

✓ Continue collecting W-9 forms – You don’t know upfront if payments will exceed $2,000

✓ State requirements may differ – Some states maintain $600 thresholds regardless of federal changes

✓ Inflation adjustments begin 2027 – The $2,000 threshold will be adjusted annually for inflation starting in 2027

✓ Backup withholding threshold also increases – 24% backup withholding applies only when payments exceed $2,000

The 1099-K Change: Critical Distinction

Form 1099-K reports payment card and third-party network transactions. Understanding the difference is critical.

Two Different Thresholds

Third-Party Settlement Organizations (TPSOs) – PayPal, Venmo, Cash App, Square, etc.

- Threshold: $20,000 AND 200+ transactions

- Permanent: Restored by OBBBA, applies retroactively to 2022

- No inflation adjustments

Payment Card Processors – Credit/debit card transactions through banks

- Threshold: NONE – All amounts must be reported

- This has NOT changed

What OBBBA Did

OBBBA permanently restored the original $20,000 + 200 transaction threshold for TPSOs retroactively to 2022. This reversed the American Rescue Plan Act’s $600 threshold that was never fully implemented.

For payment card transactions: There is no minimum threshold. Any amount paid via credit or debit card should trigger 1099-K reporting by the processor.

Tax Obligations Don’t Change

Even without receiving a 1099-K, all business income must be reported on tax returns. The threshold change affects payer reporting obligations, not recipient tax obligations.

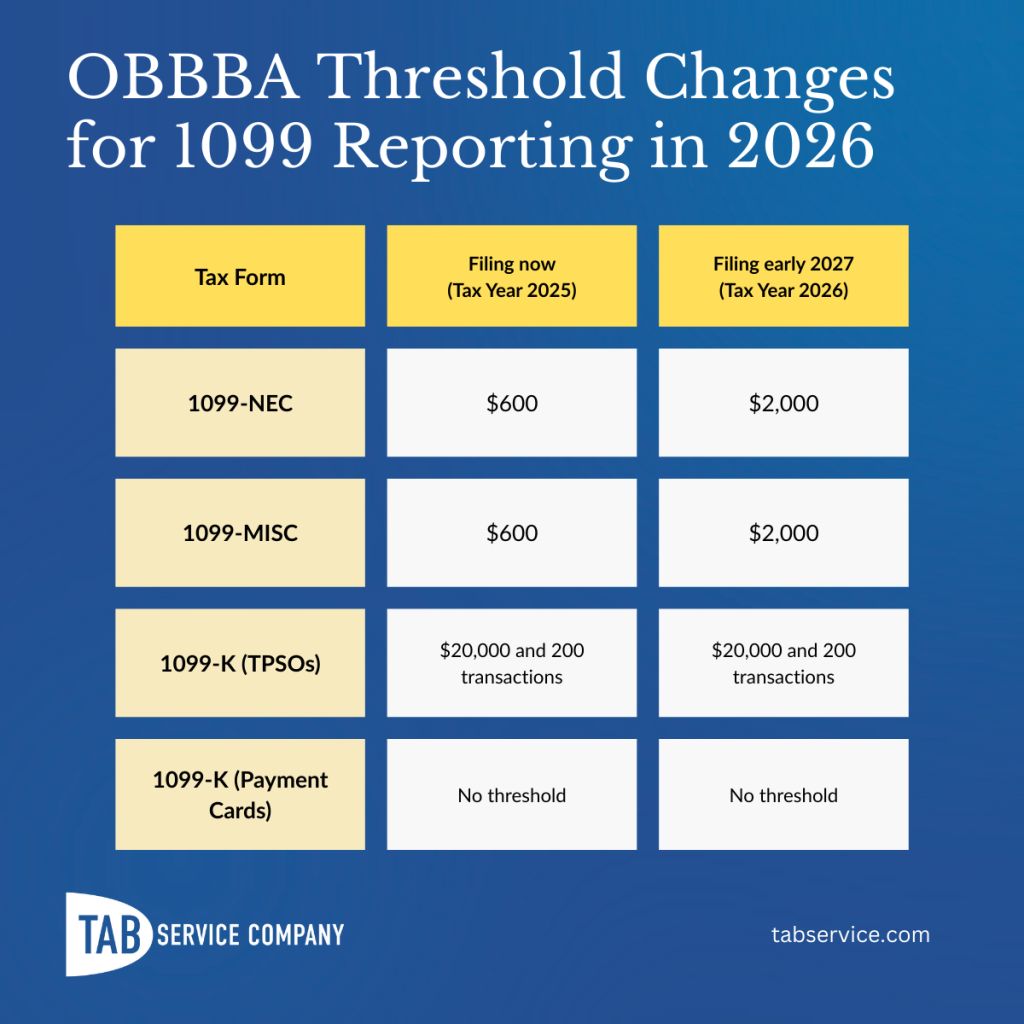

Reporting Thresholds in 2026 and 2027 at a Glance

| Form Type | 2025 Tax Year (Filing Now) | 2026 Tax Year (Filing 2027) |

|---|---|---|

| 1099-NEC | $600 | $2,000 |

| 1099-MISC | $600 | $2,000 |

| 1099-K (TPSOs) | $20,000 + 200 transactions | $20,000 + 200 transactions |

| 1099-K (Payment Cards) | No threshold | No threshold |

Other 1099 forms (INT, DIV, R, B, S) maintain their own separate thresholds and are not affected by OBBBA.

Frequently Asked Questions

Can I use the $2,000 threshold for 2025 payments?

No. The law specifies the $2,000 threshold applies to “payments made after December 31, 2025.” For 2025 payments, use the $600 threshold.

Do the new thresholds apply to all 1099 forms?

No. The $2,000 threshold applies only to 1099-NEC and 1099-MISC. Other forms maintain separate thresholds:

- 1099-INT, 1099-DIV, 1099-R: $10

- 1099-B: All transactions

- 1099-S: $600

What about state filing requirements?

Federal thresholds don’t automatically apply to states. Some states (like Massachusetts and Vermont) maintain their own requirements. Always verify state-specific obligations.

Do I need to amend previous 1099-K filings?

No. While OBBBA applied retroactively, payment processors that already filed under transitional thresholds don’t need to amend or withdraw forms.

State-Level Requirements

Federal threshold changes don’t automatically apply to state requirements. Key states with different rules:

Massachusetts: Requires Form 1099-MISC for payments of $600 or more regardless of federal threshold

Vermont: Has its own Form VT-1099 requirements

California: May require separate state reporting depending on payment type

Verify requirements for every state where you operate or have payees.

How Tab Service Company Can Help

Tab Service Company has helped businesses navigate tax compliance requirements since 1960. Our TAB1099 platform handles the complete 1099 filing process:

What TAB1099 Provides:

- Accepts any file format and validates data automatically

- TIN verification to prevent penalties

- Complete IRS e-filing and state filing

- Professional printing and mailing of recipient copies

- Unlimited post-filing corrections at no extra cost

- SOC 2 Type II certified security

- Dedicated U.S.-based support

Forms We Handle: 1099-NEC, 1099-MISC, 1099-INT, 1099-DIV, 1099-K, 1099-R, 1098-T, 1095-B/C, W-2, and more.

Need immediate assistance? Call our tax compliance team at 312-527-4306 or schedule a consultation.

This information is current as of January 2026. Tax laws and IRS regulations are subject to change. Always verify current requirements at IRS.gov or consult with a tax professional. This article is for informational purposes only and does not constitute tax, legal, or financial advice.